Published on Jan 06, 2022

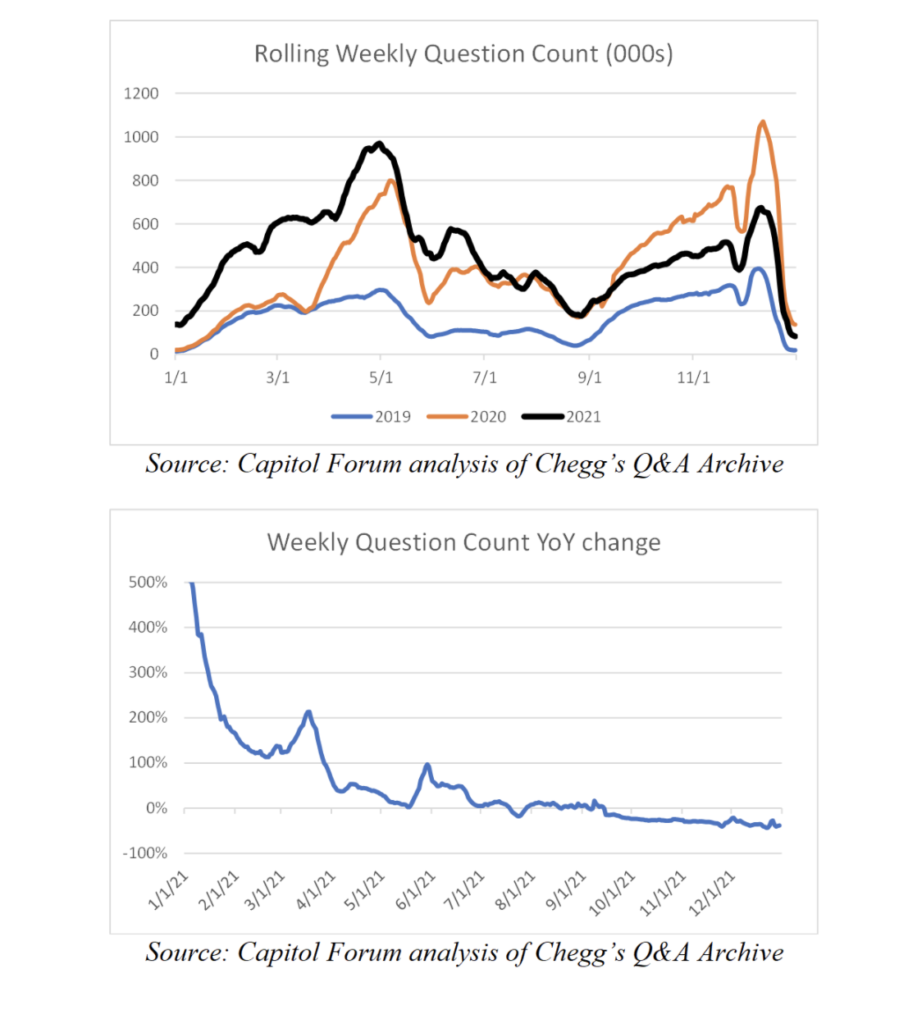

A Capitol Forum analysis of student use of Chegg’s (CHGG) question and answer service in 2021 finds that the service enjoyed robust growth during the first half of the year. However, as schools returned to in-person learning and schools became more aware of the platform’s ability to be used to cheat, the service saw negative growth on a year over year basis.

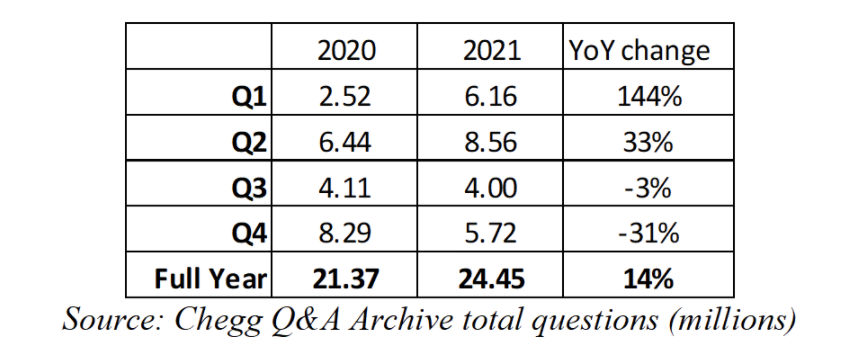

According to The Capitol Forum’s analysis, use in the final quarter of 2021 was down 31 percent relative to the same period in 2020, use in the final month of 2021 was down 33 percent, and use over the last week was down 37 percent:

Source: Chegg Q&A Archive total questions (millions)

Chegg’s fortunes are largely tied with how students use the Q&A program. While Chegg began as a textbook rental company, its academic services segment, of which the Q&A program is a major part, currently accounts for 85 percent of the company’s net revenues, according to the company’s most recent quarterly filing.

When colleges went largely virtual in response to the pandemic in March of 2020, the Q&A service saw explosive growth. However, that surge was fueled in part by students, no longer taking proctored exams in person, using the platform to cheat on exams.

Students can cheat with Chegg by submitting questions to the Q&A service and receiving an answer from one of Chegg’s experts in India within minutes. Other students who are subscribed to the Q&A service can also see that same answer, which has sometimes resulted in multiple students providing suspiciously similar answers on exams.

The speed and on-demand nature of the service have rankled teachers, who have expressed annoyance that answers to new exam questions can appear on the website within minutes of the exam starting.

“It was quite demoralizing,” Chris Neu, a professor of Physics at the University of Virginia, previously told The Capitol Forum, “I had written new questions for this exam, but I checked Chegg and could find questions that had only seen the light of day 90 minutes before and the solutions had already been provided.”

Dozens of universities, including the Air Force and Naval academies, found widespread cheating on exams by students using Chegg in 2020 and 2021. Those incidents caused school administrators and teachers to take active steps to mitigate the ability for students to cheat with Chegg, such as reformatting exams or banning access to the website on the school network.

The effect of those actions, as well as the return to in-person in the fall, appears to have taken a significant toll on student use of Chegg’s Q&A. In late October, the company acknowledged these headwinds, announcing disappointing Q3 results, lowering full year and Q4 guidance, and delaying fiscal guidance for 2022 until February, which resulted in a roughly 50 percent drop in its stock price.

While company management blamed an industry wide drop in enrollments, those national trends were outpaced by the Q&A service’s decline, suggesting that the students who remained in school were also using the service less in general.

The drop in Chegg’s stock price has resulted in shareholder lawsuits against the company, with one lawsuit claiming that Chegg’s rapid growth during the pandemic was due largely to temporary boost from cheating rather than the strength of its business model.

“The company’s statements surrounding its exponential increase in subscribers, revenues, and profits in 2020, which Chegg claimed was due to the strength of its business model and the Company’s leaders’ business acumen, were false and misleading. In reality, as students took more virtual courses and tests remotely with less supervision, students discovered they had open access to the Chegg Services apps 24/7, including for completing their homework, tests, writing assignments, and even dissertations and exams,” the complaint reads.

“Once the pandemic-related restrictions eased and students returned to campuses nationwide and schools and universities implemented protocols to eliminate cheating,” the complaint continues, “students predictably stopped subscribing to the platform. In short, Chegg had no basis to believe that the extraordinary, but temporary, growth trends would continue, but failed to adequately inform investors of that reality.”