Published on Nov 22, 2024

Excess of loss arrangements and intercompany transactions can artificially inflate an insurance company’s financial statements, according to the Rehabilitator’s First Accounting and Status Report filed in the PHL Variable Insurance Company rehabilitation proceeding.

The Capitol Forum recently reported on these concerns related to its ongoing coverage of insurance companies owned by Brookfield Wealth Solutions (NYSE: BNT).

The rehabiliator’s report was filed on November 20, in connection with the rehabilitation of failed PHL Variable Insurance Company (PHL) and its subsidiaries. The Superior Court for the Judicial District of Hartford entered an order of rehabilitation for PHL on May 20, 2024, finding that PHL and its subsidiaries were in such condition that further transaction of business would be financially hazardous to its policyholders, creditors, and the public.

Efforts to stave off the rehabilitation were unsuccessful as Golden Gate Private Equity, Inc., the company’s ultimate owner was unwilling to contribute capital, and it was under no legal obligation to do so. The Capitol Forum highlighted this risk in connection with Brookfield’s dividend-taking from one of its life insurers, as capital removed from an insurance company, even if it is maintained in an insurer’s holding company, is not guaranteed to meet the insurer’s obligations to policyholders.

Insurance is regulated at the state level, based upon nationally recognized insurance accounting standards set by the National Association of Insurance Commissioners (NAIC). However, state lawmakers can pass laws that allow “prescribed practices,” and state insurance regulators can allow “permitted practices” that deviate from the NAIC standards.

As a result of the Rehabilitation Order, the Connecticut Insurance Department (CID) decided to revoke permission for accounting practices that the CID had previously permitted PHL to use, including practices related to the asset treatment of the excess of loss agreement between PHL’s subsidiaries Concord and Palisado should be discontinued.

The permitted excess of loss accounting practice is an opaque and complex transaction that could arguably be considered accounting arbitrage. It involves a two-part process.

First, the insurer establishes a special purpose “captive” affiliate; the captive executes agreements—called “excess of loss,” or “XOL”—between the captive and another reinsurer, often a third-party; and state regulators permit the captive to claim the XOL agreements as assets on the captive’s books.

Then, the captive’s parent insurer shifts, or “cedes,” risk to its artificially asset-rich captive, takes a “reserve credit” that lowers the insurer’s liabilities, and indemnifies the captive’s XOL counterparties.

When the petition seeking rehabilitation was filed in May, projections showed the PHL entities’ approximate capital and surplus was negative $900 million. Revised financial statements for Q3 2024 that removed intercompany transactions, including the asset treatment of the excess of loss agreement, resulted in the deficiency increasing to negative $2.1 billion, according to the report.

“The discontinuance of these permitted practices increased the capital and surplus deficiency of the Companies relative to the Initial Deficiency by a material amount,” the rehabilitator wrote.

To be sure, other factors, including cash flow testing of the PHL entities reserves and impairment of an affiliate loan also contributed to the increase in the deficiency.

The Capitol Forum last week reported on similar XOL intercompany accounting maneuvers employed by Brookfield’s American Equity Investment Life Insurance Company (AEILIC) and its two special purpose captives, AEL Re Vermont I and AEL Vermont II.

Again, the maneuvers are permitted by Iowa and Vermont state insurance regulators who oversee the Brookfield insurer and its affiliates; however, they fall outside of nationally recognized insurance accounting standards, and the practices be putting the retirement security of policyholders and annuitants at risk.

A spokesperson for American Equity previously told The Capitol Forum in an email that “In the United States, insurance is a highly regulated industry, and our state-based insurance regulatory system has a demonstrable history of effective policyholder protection.”

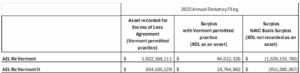

The dollar figures involved in the Brookfield transactions are in the billions. AEL Re Vermont recorded a $1.6 billion asset for its XOL agreement with Hannover Re. AEL Re Vermont II recorded a $934 million asset for its XOL agreement with Canada Life Re.

If Vermont had not permitted the recording of these agreements as assets, the reinsurers would have had deeply negative surpluses of negative $1.5 billion for AEL Re Vermont and $915 million for AEL Re Vermont II.

With the XOL agreements recorded as assets, both captive reinsurers appear to have millions in surplus, $94 million surplus for AEL Re Vermont and $19 million surplus for AEL Re Vermont II.

Source: 2023 Annual Statutory Filings for American Equity Investment Life Insurance Company, AEL Re Vermont, and AEL Re Vermont II

The captives’ parent, AEILIC, took a $3.6 billion reserve credit for risk ceded to its Vermont captives, thereby slashing its liabilities. The result was AEILIC reporting a surplus of $3.7 billion, of which $3.6 billion, or 97.2%, is directly attributable to the reserve credit. But for the reserve credit, AEILIC’s surplus would be $103 million.

Source: 2023 Annual Statutory Filings for American Equity Investment Life Insurance Company, AEL Re Vermont, and AEL Re Vermont II