Published on Mar 03, 2023

The Centers for Medicare and Medicaid has proposed changes to the risk adjustment model that will reduce or eliminate some of the extra money the agency pays to Medicare Advantage plans to manage and treat certain chronic conditions.

In focus are certain inappropriate coding practices that target lucrative diagnosis codes that companies like Signify Health (SGFY) and Oak Street Health (OSH) encourage their staff or contractors to apply to patients’ medical records, as previously reported by The Capitol Forum.

Currently, CMS pays Medicare Advantage plans a baseline per-member capitation rate plus additional risk-adjusted amounts for many chronic conditions that are expected to increase the cost of care. As previously reported by The Capitol Forum, regulators including the DOJ, former CMS officials, lawmakers, watchdog organizations, and advocates for traditional Medicare have been sounding the alarm for years about strategies used by Medicare Advantage plans and providers to harvest lucrative diagnosis codes to boost capitation revenue.

The changes proposed by CMS will reduce payments for certain overused diagnoses, including diabetes with complications, and eliminate payments for others, such as vascular disease without complications and malnutrition.

Taken together, the changes to the risk adjustment model are expected to result in a $11 billion net savings to the Medicare Trust fund in 2024, according to CMS projections in the Advance Notice of Methodological Changes for Calendar Year (CY) 2024 for Medicare Advantage (MA) Capitation Rates and Part C and Part D Payment Policies.

The Medicare Advantage industry has sounded the alarm about the CMS proposal, with some physician groups estimating that they could face payment cuts of up to 10% to 20%, according to Susan Denzer, president and CEO of America’s Physician Groups, in an opinion piece in Heathcare Innovation.

CMS will release the final methodology on April 3. While CMS may cave to some industry pressure in its final rule, it is clear that CMS is targeting excessive upcoding, especially when the presence of specific diagnosis codes does not equate to an increase in the cost of care.

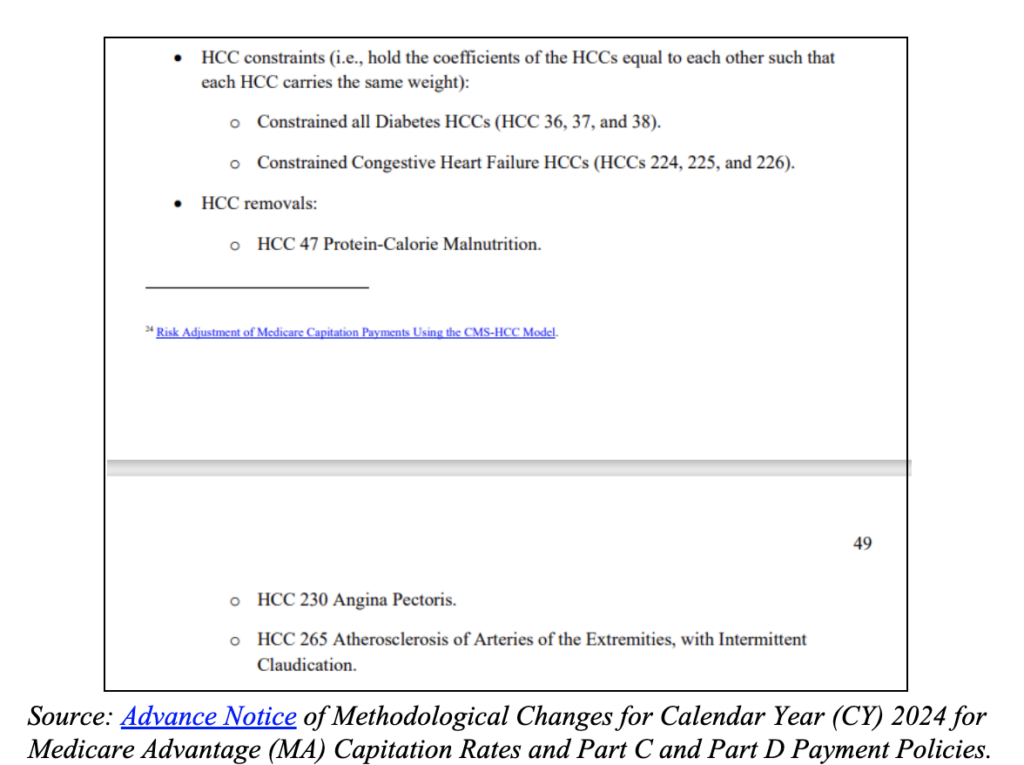

Proposed revisions are based on a “Principle 10-focused” CMS review of diagnoses. Ten longstanding principles have guided CMS in the development, evaluation and revision of its risk adjustment models, according to the Advance Notice.

Several of the proposed changes to the risk adjustment model are focused on Principle 10, which directs CMS to exclude diagnoses that are not consistently applied across the industry and “that are not clinically or empirically credible as cost predictors,” according to the Advance Notice.

Simply put, Principle 10 guides CMS to look for diagnoses that are disproportionally applied to Medicare Advantage beneficiaries and analyze if those diagnoses add to the cost of care for those members.

In the case of Oak Street Health, The Capitol Forum found that the company was searching for diagnoses without any plans for follow up care to treat those same diagnoses.

“Testing was essentially a fishing expedition to find potential risk adjusting codes,” a former Oak Street Health physician previously told The Capitol Forum, who explained that unearthing diagnoses codes was the goal and often did not lead to Oak Street expending resources to treat the diagnoses.

“Often screening would turn up a positive result, but there was no protocol for treatment so as to modify that risk factor to actually make a difference in outcomes,” said the former Oak Street physician.

Separately, a Signify Health clinician recently told The Capitol Forum that “they are looking for anything to upcode. That is what all the testing is about.” The Capitol Forum previously reported on Signify clinicians’ concerns about the adequacy of follow-up care after Signify in-home health evaluations.

Those scenarios, whereby conditions are coded but not cared for, are what CMS appears to be looking for when conducting a Principle 10 analysis.

Excessive prevalence of lucrative diagnoses suggest CMS proposal is likely to have a negative impact on some Medicare Advantage plans and provider groups. Oak Street Health, as previously reported by The Capitol Forum, is intently focused on diagnosis code metrics, aggressively pitting clinic locations against one another to meet certain prevalence rates for certain diagnoses that increase capitation payments.

Additionally, both Oak Street Health and Signify clinicians were electronically prodded to document several suggested diagnoses for every patient at every appointment.

Contracted Signify clinicians conducting in-home risk assessments are presented with a long list of suggested diagnoses and the option to check “active,” “resolved,” or “not confirmed.” Several Signify practitioners previously told The Capitol Forum that it was common to see inappropriate diagnoses, such as schizoaffective disorder, convulsions, osteoporosis, and even limb amputation, that they and their patients were at a loss to explain why Signify suggested the diagnoses apply.

Oak Street Health provided individualized care reports for physicians to review before each appointment. The care reports listed suspected diagnoses and physicians were expected to confirm and apply as many of the diagnoses as possible.

The care reports also displayed how much each condition would risk adjust, indicating the revenue value of the diagnosis.

Oak Street Health also mandated clinicians attend quarterly risk assessment coding updates. A presentation given by the risk adjustment consultancy Capstone Performance Systems and previously obtained by The Capitol Forum instructs clinicians on “Detecting, Documenting, and Proper Coding of Vascular Disease, CHF and Angina.”

The likely abuse of these codes may be why CMS proposed to eliminate payment for two of these diagnoses, uncomplicated vascular disease and angina, and reduce payment for complicated congestive heart failure (CHF).

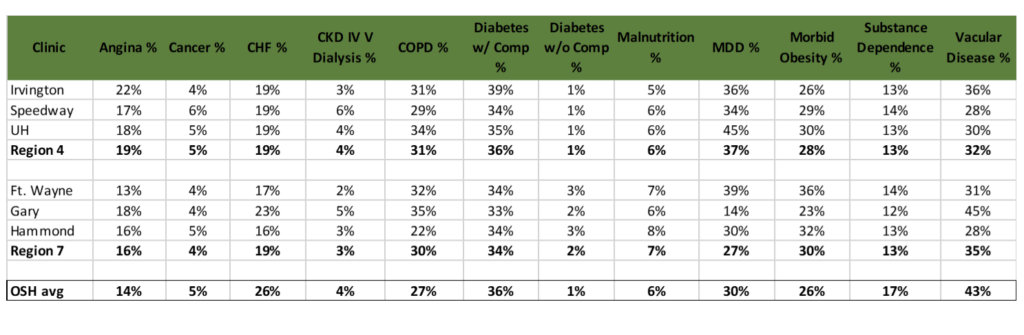

A former Oak Street Health employee previously sent The Capitol Forum a chart produced by the company in 2018 that detailed the prevalence rates of twelve chronic conditions at each clinic in Indiana. The documented Oak Street Health prevalence rates far exceed the expected prevalence of several conditions among Medicare populations:

The data from the chart suggests trends that indicate potential risk score gaming. For example, 36% of Oak Street Health’s Indiana patients have diabetes with complications, while only 1% of patients have diabetes without complications; diabetes with complications is a condition that risks adjusts substantially more than just diabetes.

Under the proposal, the CMS payment amount for diabetes diagnoses will be “constrained,” meaning payment will decrease for the 36% of Oak Street’s Indiana patients with a complicated diabetes diagnosis code while it will slightly increase for the 1% of Indiana members with the uncomplicated diabetes code.

Moreover, supplemental documents attached with the chart discussed strategies that clinics could use to increase diagnosis rates for conditions at their clinics that fell below the company prevalence average.

Should CMS Advance Notice be finalized as proposed, payment for several of these diagnoses would be eliminated. Diabetes and congestive heart failure would bring in a lower average amount since the tiers of payment for diabetes and congestive heart failure codes have been constrained to a single payment amount.

Angina, malnutrition, and uncomplicated vascular disease codes would be completely excluded from payment calculations.

Oak Street Health did not respond to a request for comment for this article. However, a representative of the company previously told The Capitol Forum that whether a condition maps to a paying diagnosis code or not “is NOT the point …We accurately document conditions that have been appropriately diagnosed.”

Proposal would largely erase incentive for QuantiFlo screening for uncomplicated vascular disease. Under the proposal, it literally won’t pay to screen for uncomplicated vascular disease. There will be no bump in capitation payments from CMS to Medicare Advantage plans and Medicare Shared Savings Programs for the diagnosis of uncomplicated vascular disease.

Currently, that screening is widely performed using Semler’s (SMLR) QuantiFlo device. Health plans pay Signify an add-on fixed fee to conduct diagnostic testing, including QuantiFlo, during home visits, according to documents reviewed by The Capitol Forum.

Medical assistants at Oak Street Health also run QuantiFlo tests during clinic visits. Several clinicians from both companies have raised concerns about the accuracy of QuantiFlo results.

“Because the final call letter will not come out until early April,” a spokesperson for Semler told The Capitol Forum in an emailed statement, “it is premature to speculate at this time about the potential impact on our customers and Semler.”

Semler’s stock price has plunged 43% in the month since CMS released the Advance Notice on February 1.

Health plans and provider groups likely won’t perform QuantiFlo screening and likely won’t pay Signify to perform QuantiFlo screening if a positive result doesn’t bump up capitation payments.

The fee Signify charges its health plan clients to screen for vascular disease is unclear. Some Signify clinicians have recently told The Capitol Forum that most of the patients they visit are scheduled to have a QuantiFlo test, even in the absence of any signs of symptoms of vascular disease. That source of revenue is likely to dry up for Signify if the proposal is finalized.

Signify Health did not respond to a request for comment. CVS (CVS) is awaiting regulatory approval of its deals to acquire Signify and Oak Street. CVS did not respond to a request for comment.