Published on Feb 22, 2023

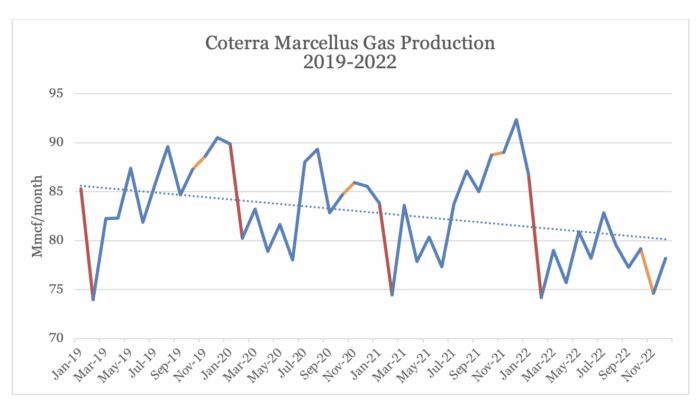

Coterra Energy (CTRA) appears on track to see its lowest annual Marcellus output since 2018, with the company reporting an average of 77 million Mcfe per month from its Marcellus wells in the fourth quarter, Upstream shows.

Coterra’s total Marcellus production in the second half of 2022 fell below the company’s first half levels, Upstream shows, in contrast with the “second half ramp” Coterra projected earlier in the year, with fourth quarter Marcellus output down roughly three percent from the third quarter.

Investors are watching closely as Coterra increases its emphasis on the relatively less tested Upper Marcellus, particularly after Coterra’s recent reserves write-down.

Monthly Marcellus production data appears to put Coterra on track to miss or come in at the low end of its fourth quarter natural gas production guidance—depending on how much gas output Coterra can add from other areas of its operations in the Permian and Anadarko. Given the outsized role that the Marcellus represents for the company, accounting for around 80 percent of Coterra’s natural gas volumes in the first three quarters of 2022, the company’s seemingly lackluster fourth quarter performance in the Marcellus adds pressure on Coterra’s other, smaller natural gas operations.

While in those two basins, Coterra aimed to maintain “steady production levels” according to its 3Q2022 earnings deck, output from its central US footprint has fluctuated this year in a range wide enough to impact the company’s ability to hit guidance despite the Marcellus downturn. That said, Coterra planned to bring just 10 to 12 Permian wells online in the fourth quarter, their lowest number of net well additions for the year. Further, the Leota Clark Anadarko wells that Coterra planned to bring online in the fourth quarter are more oil-weighted than their recent Anadarko projects—raising the potential for a company-wide natural gas production miss in the fourth quarter.

Natural gas has historically played an outsized role for the company’s revenues with oil consistently representing roughly a third of revenues and NGLs bringing in around ten percent whereas in the third quarter for example, 62% of Coterra’s revenue came from natural gas.

Coterra did not respond to a request for comment.

The Capitol Forum’s estimates for Coterra’s fourth quarter volumes compared to guidance are based on numbers from Upstream, which draws from monthly production data reported by Coterra to state regulators in the Marcellus. If that data is incomplete, Coterra’s fourth quarter performance could prove to be better than the data suggests.

The overall trend of declining annual production from Coterra’s assets has drawn the eye of investors concerned that Coterra’s former “core-of-the-core” acreage may be running out of Tier One drilling prospects and suffers from sharp decline rates.

Coterra will announce its fourth quarter results after the market closes on Wednesday, Feb. 22, followed by a Thursday earnings call.

The company is also expected to update its reserves figures, following last quarter’s write-down, which CEO Tom Jorden tied largely to “aggressive” production models for legacy Cabot wells and infill drilling issues in the northeast Pennsylvania dry gas core of Susquehanna County.

Management cited “lumpy” production profile in prior quarters—but downturn appears prolonged. Coterra’s leadership has often emphasized that the small number of wells it brings on each year can make production look “lumpy” depending on when individual wells come online.

“It’s not always easy for us to cover our cadence or to smooth out our cadence because we don’t have 10 rigs running. We don’t have five or six frac crews. We don’t have that mix of pads where you can balance out a new pad coming on at various different times. We’re more lumpy just by the nature of being a very low capital intensity company,” Cabot CEO Dan Dinges, now on Coterra’s board of directors, said in an April 2021 earnings call.

And indeed, the company has historically seen individual months with sharply lower production even during highly productive years. For example, output tends to drop sharply from January to February, Upstream shows, with its monthly output for example plunging below 74 Mmcfe in February 2019 – the same year Coterra went on to report its highest-ever Marcellus production.

It’s relatively uncommon, however, for the company to report a sharp October-November drop as it did in 2022, according to Upstream.

Data Source: TCF Upstream. Jan.to Feb., highlighted in red, Oct. to Nov. highlighted in orange. Linear trendline shown by dotted line.

Coterra initially predicted that its 2022 Marcellus output would decline compared to 2021, suggesting investors should look for a “return to growth in the Marcellus” in 2023. But at the end of the first quarter of 2022, Coterra predicted a second-half ramp would buoy its Marcellus production.

That first quarter, however, appears to have been Coterra’s most productive of the year.

As 2022 kicked off, Coterra added a third rig in Appalachia, saying the move would help raise production at the tail end of the year. “We just added a third rig in the Marcellus,” Tom Jorden said when Coterra initially released its 2022 guidance. “And so when you do the lead time on that, you’re looking way late in the year before you’re going to see the impact of that investment today.”

Despite that added rig, Coterra’s average monthly production for December was just 78.2 Mmcf, Upstream shows, down from 86.8 Mmcf in January (and an all-time peak of 92.3 Mmcf at the end of 2021).

Coterra’s apparent difficulties come as the company has begun shifting from targeting the Lower Marcellus to targeting the less hydrocarbon-rich Upper Marcellus formation. Though management celebrated results from recent Upper Marcellus wells, a Capitol Forum analysis in December found that those Upper Marcellus wells nonetheless cost more and produce less than Coterra’s recent wells in the heavily-drilled Lower Marcellus, which suffers from parent-child interference issues.

“Aggressive” models for legacy Cabot wells blamed for third quarter reserves writedown. Jorden, who previously helmed Cimarex prior to its merger with Cabot Oil & Gas to form Coterra, tied the merged entity’s Marcellus reserves writedown to two main factors in a Q&A with BofA Securities on Nov. 16.

With Cabot’s legacy wells, “quite frankly, the forecasts on these wells were a little aggressive compared to the performance of the wells,” Jorden said, adding that it’s not until an individual well approaches about five years online that the estimates Cabot used in reporting its proved reserves and Coterra’s new modeling begins to show “any significant divergence.”

That sharper-than-recognized decline as wells age means Coterra now expects its Marcellus wells will ultimately produce less than Cabot had forecast. “For a new well, it has about a 15 percent reduction – mid-teens, I’ll say – in full-life reserves,” Jorden said.

The second factor in the reserves writedown comes from parent-child interference and the resulting need to space wells further apart, Jorden said, meaning that Coterra now has fewer total locations in the Marcellus to drill. In addition, Coterra appears to be pushing back the timeline for some locations beyond the five-year period the SEC allows for drilling proved undeveloped reserves. Jorden noted that about 60 percent of the impact to Coterra’s proved undeveloped reserves in the Marcellus came from removing those wells from Coterra’s proved reserves – but they still intend to drill those locations eventually. “Those wells went back into our inventory,” he said.

Jorden indicated that the numbers Cabot used for internal drilling decisions hadn’t matched up with the numbers the company used to report its proved reserves (which are audited numbers relied upon, for example, to support reserves-based loans). “We observed that the production was below type-curve and we said, ‘how in the world can that Cabot team be so good at hitting their guidance?’ Well, the reason for that is because reserves were never the basis of a cash-flow or production projection,” Jorden said.

“And this approach that we took with our reserve revision just sort of heals a little bit of that,” he said. “We just want everything to tie.”

Historically, Cabot relied more heavily on reserves-based loans (RBLs) than Cimarex, a Barclays Capital analyst pointed out during the May 2021 merger announcement. In response, Cimarex executives indicated the newly formed company would work to reflect a mix of both company’s financing approaches.

Cimarex management aware of Cabot reserves issues in merger discussions. Cimarex had been aware of the Marcellus reserves issues going into its merger with Cabot, Jorden said at the BofA Securities event. “If you look at our S-4, you’ll see [Cimarex used] technically-adjusted numbers” for Cabot’s reserves in negotiating the deal,” he said. “Now this was, you know, did we have rock-solid, take-it-to-the-bank certainty? Of course not. But we had enough of an indication to model it into our numbers pre-Coterra.”

Back in May 2021, Jorden gave little public hint of the extent of those issues and what sorts of technical adjustments it used when JPMorgan analyst Arun Jayaram asked for “any update on any technical work you’ve done on Cabot’s asset” and the “tier-one inventory depth that you see for Cabot” during the merger announcement call.

“We love the Lower Marcellus,” Jorden replied. “We think there is a tremendous opportunity yet in the Lower Marcellus. And I think the [Upper] Marcellus, quite frankly, is underappreciated. I think the Upper Marcellus, if you really tear this apart, is going to surprise to the upside, and we’re going to prove that over time.”

“When you look at the quality of Cabot’s PDP [proved developed reserves], when you look at the quality of Cabot’s inventory, when you look at the balance sheet, we think this is a fantastic transaction for the Cimarex shareholder,” he added.

Analysts had responded with skepticism to that May 2021 announcement that Cimarex would merge with Cabot to form a company boasting of “best in class” assets across multiple basins. “I just want to ask if – was this the best deal for both companies? And what I mean is there’s no operational overlap,” BofA Securities analyst Doug Leggate asked during the merger announcement call. A Capitol Forum analysis at the time found that production was already cooling off in Susquehanna County and that Cabot’s wells experienced unusually sharp declines.

To compare, peer EQT emphasized in its most recent earnings results that its “core lower Marcellus formation accounts for ~99% of proved undeveloped reserves,” adding that it includes “essentially no future bookings associated with secondary targets.”

There may be further adjustments to Coterra’s reserves coming when the company announces its fourth quarter results—though it’s not yet clear whether those will be upwards or downwards adjustments.

“This is really a fourth quarter process,” Jorden said during Coterra’s third quarter earnings call. “We’ve got an auditor that we’d like to get their reserve audit. We have a lot of remaining work to finish that out. And if I could indulge you to hold that question until we’re finished in the fourth quarter, I think we can be pretty forthcoming.”