Published on Jul 30, 2021

Eargo (EAR), a manufacturer of completely-in-canal (CIC) hearing aids, promises customers a 45-day risk-free trial period as well as offering up to 0% interest financing for its hearing aids. A Capitol Forum investigation, however, finds that the company regularly fails to honor the trial period and that the 0% financing option through Ally (ALLY) may be misleading for consumers.

These practices could come under the scrutiny of Health and Human Services Secretary Xavier Becerra, who was a strong proponent of consumer protections during his time as the California Attorney General.

In a recent Senate hearing, Becerra was asked by Senator Chuck Grassley (R-Iowa) about the FDA’s long delayed regulations for over-the-counter hearing aids, and Secretary Becerra responded that consumer protection would likely be a priority in the proposed rule.

“Senator, I know that we are in the works,” Becerra replied, “I asked about this myself. I asked because my mother asked me what we were going to deal with this because she is one of those victims of those hearing aid commercials and so forth, and she’s fed up with what happened with her. And she’s been out some money. But I will tell you this. We are trying to work diligently to put this regulation out there. We know millions of Americans will benefit if we can help them make sure they’re good consumers of hearing aids.”

In addition to stronger protections for hearing aid financing, the FDA’s coming hearing aid rule could also create stronger protections for consumers wishing to return their products. In anticipation of the regulations, which have been delayed, several hearing care associations published a consensus paper in 2018 urging the FDA to establish strong consumer protection regulations in coordination with the FTC.

“Specifically, the [association’s] Working Group strongly recommends that return and refund policies be defined for this new category,” the paper reads.

Stronger consumer protection regulations in the forthcoming rule could make it harder for Eargo to run the clock on the return period and deny customers refunds and returns.

Eargo reports revenue net of expected returns and notes that its return rate impacts its reported net revenue and profitability. In its most recent annual filing, the company notes that, “if we are unable to reduce our return rates or if our return rates increase, our net revenue may decrease or grow more slowly than we anticipate, and our business, financial condition and results of operations could be adversely affected.”

Eargo declined to provide comment for this article.

Experts point to placement, terms of financing deal as misleading. Eargo markets financing as low as 0%, with the company telling consumers that they can “pay for [their] purchase over time with simple monthly installments that match [their] budget.” The financing is offered through Bread Financing and other reputable lenders like Ally, according to the company’s website.

It is not known what causes the company to offer financing through Bread in some cases and Ally in others. Eargo marketing materials The Capitol Forum reviewed state, “For phone orders, we also offer financing through Ally Lending (formerly HCS) who offers a secure and easy process for most credit tiers.”

After a Capitol Forum journalist began but did not complete the purchasing process through Eargo’s website, the journalist received an email offering a $200 discount and stating that, “We have affordable financing through Ally Lending (formerly HCS) which offers a secure, easy process for most credit tiers and has an option for 24 month, interest-free financing with no money down.” (Emphasis in original.)

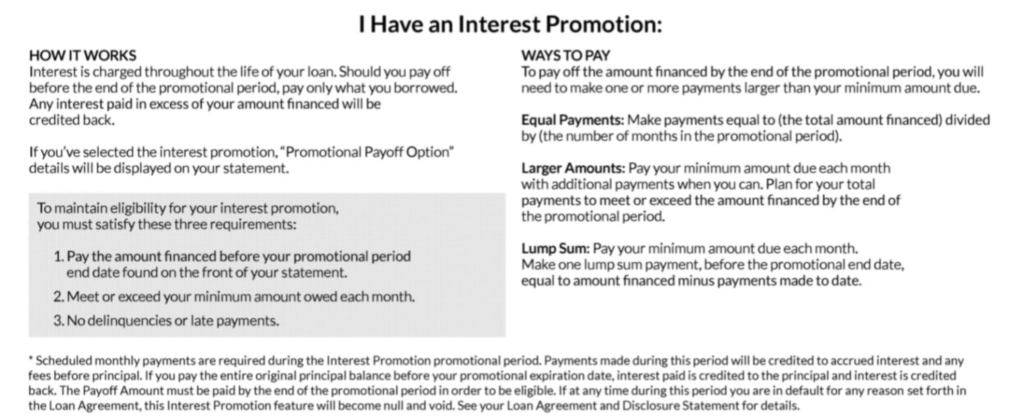

However, the 0% financing through Ally is neither simple nor automatically applied but is instead contingent on consumers finding and understanding the complex terms of the agreement.

According to consumer finance experts interviewed by The Capitol Forum who reviewed documents associated with the 0% financing offer through Ally, the agreement contains confusing provisions in its fine print that would likely trick consumers into missing out on the interest-free offer. Rather than a true 0% interest deal, Eargo and Ally offer instead a 0% “interest promotion” that requires consumers to calculate and make additional payments that are necessary to trigger 0% interest.

The financing experts pointed to a provision on the second page of the agreement that informs consumers that to qualify for 0% financing, they would have to “make one or more payments larger than your minimum amount due” without informing them how large that payment needs to be. That provision, according to the experts, most likely gets missed by consumers, resulting in them paying interest for their hearing aids.

According to Professor Jeff Sovern of St. John’s University School of Law, “providing key information only on the back of the form might possibly be deceptive in some circumstances. The information about the interest promotion is also on the bottom third of the page, beneath the Fair Credit Billing Act disclosures, which will probably cause many consumers to stop reading.”

“I don’t see how any average consumer, particularly an elderly consumer, for whom this is clearly designed, can understand this financing arrangement. I had to review it several times to figure it out myself,” Professor Roger Bertling of Harvard Law School said, adding that, in his opinion, “I think this is designed to result in most consumers paying far more than the amount financed and is something to be avoided.”

Even if consumers were to find that information, however, experts say that it is unlikely that the typical person would be able to decipher the requirements. In particular, experts pointed to the fact that the agreement does not actually spell out the dollar amount over the invoice amount a consumer would have to pay in order to trigger the 0% deal, requiring consumers to do a fair amount of math:

Source: Eargo/Ally Lending Account Statement

Given that Eargo sells its hearing aids for between $1,500 and $2,950, consumers who miss out on 0% financing agreement could end up paying more than the full price for hearing aids.

Mark Benson, a retired veteran who previously used Starkey hearing aids, told The Capitol Forum about his difficulties in understanding the 0% financing option the company offered.

Benson recounted that Eargo promised him a 45-day, risk-free trial period and 0% interest financing in both marketing text messages and phone calls. But, according to Benson, the company failed to mention that this was part of a promotion he’d have to meet certain conditions to receive.

After making a few monthly payments, Benson noticed that his statements showed he was paying interest.

“I was shocked. I have congestive heart failure, so I was very sick at the time the bill came in, and I just paid it and I didn’t look. It took me about two, three months to realize hey, wait a minute, they’re showing interest here and so I got a hold of them, and it took a while for them to explain to me that, ‘No, as long as you keep paying it’ll be okay.’ And I said well, I feel a little uneasy about you showing that I’m paying almost half of my payment in interest. They said well, as long as you make a payment, it’s fine.”

But the consumer protection experts The Capitol Forum interviewed all reviewed Benson’s agreement with Ally and found that if Benson continued to pay the amount he was billed each month—without an extra payment—he would not receive the 0% financing benefit.

“It makes no sense,” Martin the law professor at the University of New Mexico said, after reviewing Benson’s agreement. Discussing the specific agreement, Martin said, “It says that the amount financed, the price of the hearing aids, is $2,350. They are billing $80.55 per month, supposedly for 48 months for a total of $3,866.40, including the interest. Yet it also says that the interest promotion deal is for 24 months. It then says that you must pay both principal and interest during the promotion period but that paying only the monthly minimum will not pay off the purchase balance before the end of the promotion period.”

“And indeed, paying just $80.55 a month will result in payments of just $1,933.20 over the 24 months. You would need to know to pay an extra $416.80 to get their ‘0% interest’ deal,” Martin concluded.

“Why would you make the minimum payments less than what was needed to get the deal, other than to trick people?” Martin said.

After reviewing Benson’s agreement, Margot Saunders of the National Consumer Law Center said that, in her opinion, “all of this is math, which you’re not supposed to have to do, makes the contract, the whole transaction deceptive, if not fraudulent.”

Other parts of the agreement left experts equally concerned.

“What does it mean to make ‘additional payments when you can’?” Bertling asked, “What if you can’t make additional payments? It’s very confusing.”

Ally provided a sample agreement to The Capitol Forum that was identical to Benson’s agreement.

In response to a request for comment, a representative for Ally agreed that the process can be confusing for consumers but told The Capitol Forum that the company tries to educate consumers about the terms of the 0% interest promotion when they, “apply for financing, on their Statement each month, and in their 24/7 online payment portal.”

The representative also said the company provides consumers with tools to calculate the necessary additional payments and the representative provided The Capitol Forum with those documents.

Finally, the representative noted that Ally was working on offering a true 0% interest product in various verticals, but that option was not available in the audiology vertical yet.

Eargo aggressively sells but has little follow up, pushing customers past the 45-day trial term. In addition to the 0% financing deal, Eargo also offers a 45-day risk free trial of its hearing aids, which may help to attract even more wary consumers. Indeed, in the email received by the Capitol Forum journalist who started the process of buying hearing aids through the company’s website, the company highlighted in bold a “risk-free, 45-day trial period.”

Customers interviewed by The Capitol Forum say that when they tried to inform Eargo within the free trial period that their hearing aids did not work satisfactorily, the company either slow-walked their requests or continually suggested fixes that ultimately pushed the consumer outside the 45-day window.

“The first time I heard about them, I filled out a form for more info and they started calling me almost every day, many times a day,” one Eargo customer told The Capitol Forum, “I got text messages and calls and marketing from them asking me to purchase Eargo.”

“Eargo aides did not even help a bit,” the customer said, “They have a 45-day refund period, and I complained within 7 days of this problem. I tried to contact them many times to ask them for a refund and they never answered. Finally, they contacted me and told me a refund was not possible because the trial ended… but they just waited for the end of the trial.”

After experiencing several issues with the fit and performance of the Eargo hearing aids and requesting a refund, the customer said that Eargo “told me I have to wear them again at least one month more to see the benefit… of course the trial period finished by this time.”

Other consumers indicate that, even when Eargo customer services responds to complaints and refund requests, the company often suggests fixes that effectively run the clock past the 45-day window.

One consumer who received Eargo hearing aids last October spoke to The Capitol Forum about her experience. The consumer initially reached out to Eargo about issues with the hearing aids within a week of receiving them, but was repeatedly encouraged to keep the product.

“Every time I would call or email, they kept acting like I just needed to do something different or I wasn’t keeping the devices clean enough, or I need to let the devices totally die after a few days of not putting them on the charger and then charging them back up fully, cleaning them very lightly with alcohol to make sure all potential ear wax was off the contacts—which I continued to do, but nothing makes a difference.”

The consumer emailed Eargo in February of 2021 to request a refund, which the company refused, citing that she was outside of the 45-day trial period.

She also noted Eargo’s slow response time, including from the Senior Manager of Client Care. “It’s a pain between calling and being on hold for 20-40 mins to talk to someone, or email which takes days to get a reply,” she said.

Eventually, this consumer did receive a refund—but not until after she filed a complaint with the Better Business Bureau.

Dozens of other online complaints echo these issues, with complaint to the Better Business Bureau stating that “when I let them know during the trial period that the hearing aids did not provide me with any benefit, they asked me to try them 30 days more to get a benefit, [but] of course, the trial time would finish by this time.”

In this customer’s case, Eargo eventually replaced the devices after the customer filed a complaint with the Better Business Bureau. But the customer noted that after the replacement, “the devices are now working worse than ever, I can not talk with them by phone or even have a conversation with people, I am not wearing them right now. Please provide me with a return label and refund.” The ultimate resolution is not known.

CIC hearing aids have high return rates in general; Eargo has high exposure to returns. In its most recent annual filing, Eargo estimated that its customer return accrual rates were approximately 26% for the year ended December 31, 2020. While that may seem high, industry observers tell The Capitol Forum that completely-in-canal hearing aids generally have a higher return rate than typical hearings aids that are worn behind the ear.

Audiologist and CEO of the website Hearing Tracker Abram Bailey explained that hearing aids have high appeal because of their low profile, but often perform worse relative to traditional hearing aids.

“Historically, the return rate/trade in rate has been much higher for completely-in-canal (CIC) style devices, and this is due to comfort and other factors,” Bailey wrote to The Capitol Forum.

“Some people want invisibility and discretion, so [they] request a CIC or IIC [Invisible in the Canal]… but due to the comfort, own voice (occlusion), lack of features, potential for feedback, and other factors, the return rate is higher. Eargo is probably closest to what we call ‘instant fit CIC’ as a form factor, so really their return rate is not that unreasonable.”

“The difficulty I think for Eargo is that’s the only form factor they offer currently, so their overall exposure to returns seems a lot worse,” Baily added.