Published on Dec 04, 2017

Company Update

Health Insurance Innovations (HII) is a third-party administrator (TPA) that functions as a middleman between health insurers and customers looking for affordable health insurance plans. The short-term medical policies, ancillary insurance, and health benefit plans HII administers are sold outside of the ACA marketplace, and therefore are not considered qualifying health coverage under the Affordable Care Act.

A distribution network of HII-owned websites and about 100 third-party call centers sell insurance products underwritten by insurance companies. HII collects payments from customers on behalf of insurance companies and remits commissions to the third-party call center that sold the customer the policy.

The company has come under public scrutiny for its relationships with some third-party call centers, as consumers allege in various forums that call center sales agents have made false or deceptive representations to sell insurance policies. As one former sales agent told us, “I did whatever it took to make money; I lied over the phone as well.”

HII insists it has “market-leading compliance,” and attempts to distance itself from and avoid responsibility for the statements made by the third-party call centers. In a phone interview with The Capitol Forum, HII CEO Gavin Southwell said of the call centers, “They’re privately-owned, so they kind of are what they are.”

But the sales practices of third-party call centers are under scrutiny by state regulators, as the company discloses in its most recent 10-Q that several states, including Florida, are looking into the sales practices of independent call centers.

In addition, the scope of the multistate examination that previously included a review of HII’s sales, marketing, and administration of insurance plans, in conjunction with the multistate examination of HCC Life Insurance Company, was expanded in March of this year in two important ways. First, the modified warrant explicitly calls for a review of not only HII, but also “its affiliates, parents, subsidiaries and assigns.”

Second, while the original warrant at least implicitly seemed to focus only on policies underwritten by HCC, the modified warrant explicitly references “insurance products for all carriers, agencies, sub-agencies, agents, sub-agents, producers, contractors and other parties with whom HII conducted business.” Forty-two states have joined the examination.

The warrants provide that the multistate examination will build on any other examinations, investigations, or legal proceedings conducted by “Participating States” which the warrants define as those states electing to participate in the examination. Importantly, the warrants indicate that Florida is one of the Lead States in the examination, so it is likely that, at a minimum, the examination will build on Florida’s review of the sales practices of the call centers. If the other states that are examining the sales practices of call centers are also Participating States in the multistate examination, the multistate examination will likely build off of those examinations as well.

To better understand the customer experience in purchasing policies sold by call centers and administered by HII, The Capitol Forum made calls to HII-affiliated call centers to inquire about purchasing a short-term medical policy. In conducting our investigation of the company and analyzing potential legal and regulatory risk, we interviewed former call center employees, reviewed consumer complaints on various websites, spoke with consumers who had filed complaints with the Florida attorney general, and spoke with legal experts.

We reached out to the company for additional comment prior to publication, and the company referred us to its latest 10-Q filing and September 12, 2017 press release.

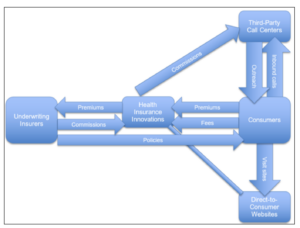

HII distribution network. A customer can purchase an HII-administered policy via one of two channels: through a call center or on a website owned by Health Insurance Innovations. The customer then pays premiums and an enrollment fee to HII, which transfers the premium payment to the underwriting insurer and keeps the enrollment fee. HII also pays the commission to the agent who sold the policy, which originates from the underwriting insurer. HII advances the commission to the third-party call center in the form of a secured loan. Below is a diagram of the relationship:

In Depth: Multistate Examination Update and Potential Penalties

Multistate examination. On June 8, 2016 the commissioner of the Indiana Department of Insurance issued an Examination Warrant to HII indicating that the Market Actions Working Group of the National Association of Insurance Commissioners had accepted a request for a review of “HII sales, marketing and administration of short term medical plans and ACA plans” between March 23, 2010 through April 30, 2016. That review was to be conducted in conjunction with a multistate examination of HCC Life Insurance Company, one of HII’s previously affiliated insurers.

Modified examination warrant. On March 6, 2017 the commissioner of the Indiana Department of Insurance issued a Modified Examination Warrant to HII. The Modified Examination Warrant notified HII that “the Examination is hereby modified to include a review of Health Insurance Innovation Inc., and its affiliates, parents, subsidiaries and assigns (collectively “HII”)’s marketing, sales, administration and claims payment of insurance products for all insurance carriers, agencies, sub-agencies, agents, sub-agents, producers, contractors and other parties with whom HII conducted business.”

HII may be understating the scope of the multistate examination. Despite the broad scope of the Modified Warrant, which notifies HII that the scope of the Examination has been expanded to include a review of the marketing and sales practices of insurance products not only by HII, but its “affiliates, parents, subsidiaries and assigns” for all insurance carriers and other parties that HII conducted business with, HII’s 10-Q states that it received notice in March that “Indiana may expand the scope and time period of the examination.”

HII also states in its 10-Q that it had additional discussions with the lead investigators on March 29, 2017, in which it sought modifications to the scope of any potential expansion to the examination. HII has not provided any updates on whether the discussions were successful, or whether the lead investigators are not conducting their examination in accordance with the terms and scope contained in the Modified Examination Warrant.

Potential penalties from multistate examination. HII CEO Gavin Southwell spoke to us about the multistate examination on September 14 of this year, saying: “We are not responsible for sales and marketing under any law anywhere and we’re not responsible for claims either.”

Southwell added, “If I were to guess the future, I think it’s likely that our market conduct review will resolve and I think it will resolve in a very friendly, amicable manner.” Southwell predicted that the examination will then focus on call center distributors.

But a spokesperson for the Utah Insurance Department, one of the states leading the examination, provided a different view. “It would depend on the facts, but generally yes, a TPA could be held liable for the acts of its agents,” the spokesperson said. A TPA may be fined up to a maximum of $2,500 per violation and up to two times the amount of the profit gained, but the actual amount of the fine would depend on the facts and circumstances of the case, the department’s representative said, citing Utah Insurance Code section 31A-2-308.

The Capitol Forum also reached out to regulators about whether a third-party administrator could be held liable for the actions of contracted call centers. In a phone conversation with the Florida Department of Financial Services, we explained HII’s advanced commission arrangement and inquired about whether the company could be held liable for the actions of third-party call centers. The spokesperson for the Department of Financial Services stated, “Generally speaking, the TPA may be held liable for the misrepresentations that are made by their partnering call centers based on the information provided in this question.”

Lawyers we spoke with held similar views. One said of the call centers that due to the advanced commission system HII uses, “You could even argue that they’re essentially an arm of the company; that they’re not independent.” Jonathan Judge, an attorney at firm Schiff Hardin who has written on multistate examination penalties, indicated that some state regulators might contend HII can be held liable for call center misrepresentations. “If so, TPAs would do well to be careful what their contracted call centers are saying about their policies,” he added.

While states may generally seek penalties under state insurance statutes, the penalty amount varies by state. According to Judge, each state does things differently, and the methodology for calculating penalties is not publicly disclosed.

In Indiana, for example, HII could risk losing its TPA license or facing civil penalties, as Indiana Department of Insurance regulation IC 27-1-25-12.4 states that “If the commissioner determines that cause exists for the suspension or revocation of a license issued under this chapter, the commissioner may, instead of suspension or revocation, impose a civil penalty not to exceed twenty-five thousand dollars ($25,000) per act or violation upon the administrator.”

One thing that may help provide some insight into potential penalties is the number of consumers who have been harmed. Judge explained that his research revealed a frequent linkage between number of consumers affected by wrongdoing and size of penalties resulting from multistate examinations. According to Southwell, there are about a million consumers on HII policies, and a press release from last month states that “Policies in force as of September 30, 2017, totaled approximately 347,900.”

In-Depth: A Closer Look at Third Party Call Centers

Company compliance efforts relating to call center operations. Southwell was elevated to CEO in November 2016 after serving as company president from April 2016. “I’m probably the only CEO and president of a public company who used to be a chief risk officer and is a compliance expert,” Southwell said.

Southwell described in a phone interview some of the recent efforts undertaken by the company to enhance call center compliance. For example, HII works with underwriting insurance carriers to develop call center scripts, Southwell said.

Then, as a compliance measure, HII adds this script to a technology platform that connects all of the agents selling HII-affiliated policies. When agents log in to the platform, “they only are allowed to access certain products” that they are licensed to sell. Southwell said the company has spent over $50 million on this technology platform in recent years.

Southwell explained that HII’s internal call-center quality team goes from center to center to train agents. The team secret shops third-party distributors, according to the press release issued in connection with HII’s third quarter results. In addition, HII has hired an independent firm to secret shop its call center distribution network, Southwell told The Capitol Forum.

This firm, according to Southwell, completes the buying process, and hears required disclosures about the fact that these policies are not ACA complaint. “We have thousands of agents every day, who are in a call center environment, and we police them very, very carefully,” Southwell said.

Seven out of 10 call center agents misrepresented coverage of pre-existing conditions. Despite the compliance efforts Southwell described, our calls with HII-affiliated call centers suggest that some still make deceptive and misleading statements in connection with the sale of insurance policies administered by HII.

We placed 10 calls to call centers affiliated with HII. We standardized the conversations, stating that we had bipolar disorder and were seeking a short-term medical plan. We also confirmed in each conversation that the call center was selling policies administered by HII and that we would be purchasing a policy administered by HII. Seven of the 10 representatives selling HII’s policies informed us that the pre-existing bipolar disorder would be covered when in fact the short-term insurance policies would not cover this condition.

Disclosures not given until after customer has purchased policy. In our experience, and based on our interview with Southwell, disclosures regarding ACA non-compliance and the lack of coverage of pre-existing conditions are only made once a customer pays for the policy. The disclosure portion of the call is recorded by HII for compliance reasons, but the sales pitch is not recorded, according to Southwell.

Based on this experience, a customer typically spends a significant amount of time on the phone with a sales representative, who assures the customer that the pre-existing condition is covered and that the policy is ACA compliant.

After supplying payment information, the consumer is read numerous disclosures—sometimes through a pre-recorded automated process—which says that pre-existing conditions are not covered, according to customers we interviewed and others who posted comments online. They described pushy sales agents who rushed through the disclosures and would not allow the consumer to see the details of the policy before making a purchase.

One consumer said on RipoffReport.com, “I was discouraged from asking questions,” so as not to interrupt the recorded disclaimer. The consumer reported, “The terms I was recorded agreeing to were different from what the first CSR had told me, so following the extended legal litany, I asked questions. I never felt satisfied with his answers, but after over an hour on the telephone, I just wanted to end the conversation.”

Another consumer wrote to the Better Business Bureau (BBB), “The whole experience is a big fat reminder to me: ‘If it sounds too good to be true it probably is,’ and ‘READ EVERYTHING BEFORE YOU SIGN.’”

The misunderstanding of consumers is illustrated in legal filings or online complaints where consumers allege that they were led to believe that their pre-existing conditions were covered and that the policies were ACA compliant. In some cases, the customers found out that pre-existing conditions were not covered only after they incurred significant medical expenses and the insurance company denied their claim.

In our conversations with sales agents, all which ended before any policy purchase, we were not read any disclosures about ACA non-compliance and the lack of coverage of pre-existing conditions.

Customer experience with call centers. Many of the complaints on consumer websites allege that call center agents made critical misrepresentations during the sale process. “I was lied to about the whole service,” one person wrote on BBB.org, “I was told that it would cover the Obamacare mandate (not true) and I would have no deductibles or co-pays in addition to life insurance.” The consumer said that services were “not even ½ covered” by this particular plan.

Consumers’ first contact with a call center often occurs when they receive unsolicited calls from call center agents selling insurance, and often call centers contact people after they visit HealthCare.gov. A Ripoff Report complaint describes one such situation, in which representatives from an HII-affiliated call center “pretended to be agents assigned from HealthCare.gov” to get the customer to buy insurance.

Another consumer received a call from a person purporting be a Healthcare.gov agent who told the consumer she didn’t qualify for the ACA-compliant insurance based on her application and instead sold her the short-term policy through HII.

During the first contact, customers are typically given a lengthy sales pitch during which the sales agent often provides assurances that the policies are ACA compliant and cover pre-existing conditions. One customer who made a written complaint to the Florida attorney general purchased a policy after an HII agent told her it would cover her pre-existing macular degeneration. “I bought the policy he suggested, went to the doctor, then received an explanation of benefits from HII, they paid zero, and stated that vision is not covered,” she wrote.

“I appealed, telling them that I was told it would be covered. They reviewed my appeal, and sent a second explanation of benefits, and they paid $189.00 of a $3,500.00 bill.” This customer estimates her medical bills totaled around $10,000, about half of her annual income. She enlisted the help of the Minnesota Department of Insurance, but was unable to obtain any relief.

Another customer said they bought coverage from HII that was initially intended to cover the customer’s husband’s hernia surgery. After purchasing the policy, they discovered that surgery was not covered. “They pay absolutely nothing and now I’m out all that money and no coverage for my medical problems,” the customer reported to the Better Business Bureau last month.

This same customer reported receiving a cancer diagnosis six months after purchasing a policy from HII: “I’m disgusted and now could die because I have no coverage for cancer care.” The consumer wondered, “How does this happen? How are these people still in business?” Another person said, “I find it hard to believe that this kind of scam is legal to operate in the United States.”