Published on Mar 01, 2022

Multiplan (MPLN), a company that provides cost management services for health insurers, touts its prices for out-of-network healthcare services as independent, fair, reasonable, analytics-based, transparent, and defensible. Multiplan and health insurers rely on the independence of Multiplan’s prices to successfully negotiate with and litigate against out-of-network healthcare providers.

However, according to a Capitol Forum investigation, Multiplan’s prices are not always independent, as the prices can effectively be set by Multiplan’s customers, which include the nation’s top health insurers.

Specifically, Multiplan allows insurers to set their own prices by overriding the prices algorithmically generated by the Multiplan’s Data iSight and Viant tools, the sources said. Evidence in a Nevada jury trial also showed insurers’ ability to manipulate or override Multiplan’s prices.

While Muliplan’s insurer-influenced price reductions can lower costs for health insurers, they can increase out-of-pocket costs for patients because out-of-network healthcare providers can bill individuals for the difference between their price and the price paid by the insurer, a practice known as “balance” billing or “surprise” billing.

Multiplan’s assertion that its prices are fair and independent is also an important protection from liability for the company and its health insurance clients; accordingly, revelations that its prices are not necessarily independent carry significant legal and regulatory risk.

Previously, health insurers who used Ingenix, a pricing provider owned by a health insurance company, were investigated by the New York Attorney General for partaking in a scheme to “defraud consumers by manipulating reimbursement rates.” The insurers ultimately settled, leading to landmark industry-wide reforms and the establishment of a not-for-profit company to develop an independent database for the determination of reimbursement rates.

In fact, the expiration of the New York Attorney General settlement is what opened the door for Multiplan to become the new “independent” reimbursement pricing provider for health insurers.

Multiplan spokesperson Pam Walker told The Capitol Forum in an emailed statement that the company “stands by all of our services, including our Data iSight and Viant pricing methodologies. We believe our solutions provide a strong value proposition to payors, health plan sponsors and members, as well as to providers. Our service offerings aim to reduce healthcare costs in a manner that is orderly, efficient and fair to all parties.”

Blue Cross Blue Shield Association declined to comment.

Health insurers UnitedHealth, Aetna (AET), Cigna (CI), Anthem (ANTM), Centene subsidiary Wellcare (CNC), and Humana (HUM) did not respond to a request for comment for this article.

Evidence that Multiplan Allows Insurers to Manipulate “Independent” Reimbursement Rates

From price caps to target pricing. When it comes to insurer influence over Multiplan’s prices, the camel’s nose under the tent was Multiplan allowing insurers to cap the rates produced by a program called Data iSight. Initially, insurers could use Data iSight to set price caps for some types of services, either as a percentage of Medicare or as a specific dollar amount, sources said. Beginning around 2015, insurers could go beyond just capping prices for services and could effectively set their own prices via a concept known as “meet or beat” target pricing, the sources said.

With target pricing, Multiplan’s tools effectively allow insurers to set the price they want to pay for services, the sources said.

The sources familiar with Multiplan’s operations also explained to The Capitol Forum that sudden drops in rates in Data iSight for specific healthcare services was an indicator that an insurer had set the rate. What happens behind the scenes, one of the sources explained, is an insurer asks Multiplan to reduce rates for a certain service such as labs or behavioral health, Multiplan recommends certain overrides to achieve the client’s goals, and the client approves the changes.

In 2018 blog post, Multiplan said it offers insurers the option to price “guardrails.” Multiplan actually admitted in a 2018 blog post that it allows insurers to manipulate the prices that Data iSight generates. “Data iSight offers a number of options, such as guardrails that ensure a reimbursement never strays below or above a benchmark,” according to the post by Multiplan on a health plan trade organization website.

Nevada Trial. Evidence of insurer influence over Multiplan’s prices came to light during a recent case in which a jury awarded Nevada emergency room physician groups $60 million in punitive damages after years of underpayments from UnitedHealthcare Group (UNH). Multiplan was not a party to the case; however, testimony about the company’s practices and documents was prominently featured.

According to recently retired UnitedHealth executive John Haben’s testimony about a document jointly compiled by Multiplan and UnitedHealth, Multiplan’s benchmark pricing option allows clients to “establish a Medicare base ceiling below which all services in the out-of-network cost management hierarchy must price in order for the savings to be acceptable.”

Multiplan executive Sean Crandell testimony also discussed the company’s practice of programming insurer-determined overrides into its tools. “The [Data iSight] tool provides services on behalf of how a client sets up an override,” Crandell testified. “The methodology produces an amount. And, then any other client or operational overrides are applied…You can apply this type of cap and whatnot separate from our—the methodology itself,” he said.

Trial testimony of three UnitedHealth executives, two active and one retired, illustrated a specific example of UnitedHealth steering a price decrease via Data iSight.

UnitedHealth had projected out-of-network billed charges would increase by eight percent in the first four months of 2019, but the billed charges actually dropped seven percent. This created a revenue problem for UnitedHealth because when insurers administer self-funded health plans for employers, they charge extra fees for lowering out-of-network medical bills. Since the fees are based on a percentage of the dollar amount cut from billed charges, the drop in billed charges signaled a drop in fee revenue. Several UnitedHealth contracts reviewed by The Capitol Forum showed self-funded employers are charged these fees, known as “shared savings program (SSP) fees,” based on about 29 to 35 percent of the difference between providers’ billed charges and what is actually paid to providers.

In early 2019, when out-of-network billed charges were dropping instead of growing as projected, UnitedHealth sought to maintain its SSP fee revenue. One way UnitedHealth achieved that was to tell Multiplan to program a lower override into Data iSight for out-of-network emergency room physician rates effective March 2019.

The price UnitedHealth paid to emergency doctors for a certain level of care dropped in March 2019 from $609.28 to $435.20, according to testimony by Haben, the retired UnitedHealth executive, on the ninth day of the trial.

Other providers see payments drop significantly when insurers use Data iSight to price self-funded employers’ out-of-network claims, indicating insurer meddling. Healthcare providers and medical billers who spoke to The Capitol Forum explained how over the past several years, they have experienced sudden, significant, and inexplicable drops in payment.

Some of the billers noted the reductions happened when an insurer began running a self-funded employer’s out-of-network claims through Data iSight. Other billers said the insurers had previously run claims through Multiplan but, all of a sudden, payment for specific services would be significantly reduced. In some cases, the healthcare providers and medical billers could pinpoint exact months or quarters when Multiplan’s rates dropped significantly from the previous rate, similar to the Nevada emergency doctors seeing a payment drop in March 2019.

The healthcare providers and medical billers said neither they nor their patients have been able to get clarity from Multiplan or insurers about why payment amounts dropped or what data was used to justify the new rates.

Multiplan Says Its Independence is a Key to its Business

According to comments made by Multiplan’s then CEO Mark Tabak on an Analyst day in 2020, the company is “recognized as a truly independent source of trusted information to the U.S. health care industry.” A company video says Multiplan’s tools allow for healthcare payors to pay providers what is fair for out-of-network services with full transparency.

The company asserts that when claims are paid according to Multiplan’s recommended rates, providers are less likely to appeal and less successful when they do because Multiplan and payors insist Multiplan’s methodologies are transparent, defensible, and hard to argue against.

Multiplan says its clients are not keen to set up their own pricing systems because payors see value in Multiplan’s position as an independent third-party with data-driven pricing systems. “If a payor decides to [generate their own rates in-house], their ability to go back to providers and push for savings is fundamentally different than ours,” said Multiplan’s president of new market during the 2020 analyst day presentation. “We are the third-party independent source, the global standard, if you will, of that data that we capture and analyze,” he added.

History of New York AG Crackdown on Price Manipulation and Emergence of Multiplan

In 2009, then New York Attorney General Andrew Cuomo established industry-wide reforms after investigating the industry’s use of a flawed, conflict-ridden database used by all the major insurers to underpay out-of-network claims. Cuomo settled with UnitedHealthcare, whose subsidiary company, Ingenix, ran the database. Additionally, every national and regional insurer operating in New York agreed to stop using the flawed database and financially commit to the development of a new, independent database, according to a press release about the settlement.

“They pretend an independent database underlies these rates—it does not,” according to a report on the findings of the investigation. “The current industry model for reimbursing out-of-network care is fraudulent. The industry uses a conflict-laden database riddled with errors at the expense of the consumer. The database is neither independent nor fair. This leads to chronically flawed decisions,” stated the report.

Two days after of the deal with Cuomo, UnitedHealth paid $350 million to settle a class action lawsuit brought by the American Medical Association (AMA) and other medical organizations which alleged the same conduct Cuomo exposed.

Following the settlements, the Senate Commerce, Science and Transportation Committee held a two part hearing focused on health insurance industry underpayment of out-of-network claims; conducted a nationwide investigation; and issued a report in 2009 on their findings.

The settlement with Cuomo required UnitedHealth to use a new database, known as Fair Health, to determine out-of-network reimbursement rates for a period of five years.

The five years ended in 2015. Soon after, UnitedHealth was in talks with then Multiplan sales executive Dale White about how to use Multiplan’s tools—and what price caps to implement—for pricing out-of-network medical claims, according to testimony elicited in the UnitedHealth trial. White was recently appointed Multiplan CEO.

Despite regrets over conflict-ridden Ingenix, UnitedHealth uses Multiplan. In the 2009 Ingenix settlement with Cuomo, UnitedHealth neither admitted nor denied any wrongdoing, but the company did acknowledge the inherent conflict of interest.

“We regret that conflict of interests were inherent in these Ingenix database products,” then UnitedHealth general counsel Mitch Zamoff said during an AMA news conference on January 13, 2009, according to an American Medical News article.

Former UnitedHealth Group CEO and chairman Stephen Hemsley also expressed “a number of regrets related to Ingenix” during a Senate hearing on March 31, 2009. “We regret we did not recognize the appearance of this conflict sooner. We regret that we were not more forceful in our broad disclosures with respect to other aspects of our company. And we regret that there has been any breach in terms of the perception of trust in terms of consumers’ participation in this,” Hemsley testified.

Former Ingenix CEO Andy Slavitt, who later went on to serve as acting administrator for the Centers for Medicare and Medicaid from 2014 to 2017, also testified in during the hearing, “It’s clear that we were myopic and being perhaps so analytical about defending our integrity that we missed the bigger picture.”

Despite regrets, soon after the five-year clock ran out on the New York settlement stipulation that required UnitedHealth to use the independent Fair Health database, UnitedHealth was in talks with Multiplan about the best use of Multiplan’s repricing services and what override to set, according to testimony elicited during the Nevada trial. Moreover, despite tampering with the rates generated by Data iSight, UnitedHealth uses descriptors such as “independent,” “transparent,” and “third-party” in legal disclosures about out-of-network rates generated by Multiplan’s Viant and Data iSight tools.

Previously, a UnitedHealth spokesperson told The Capitol Forum in an emailed statement, “UnitedHealthcare is committed to protecting people from high charges from out-of-network care providers. We offer our employer customers a variety of programs that are designed to control these costs. We will continue to collaborate with companies that share our goal of protecting consumers and their employers from high out-of-network rates and offer solutions that reduce the cost of health care while also achieving high customer satisfaction.”

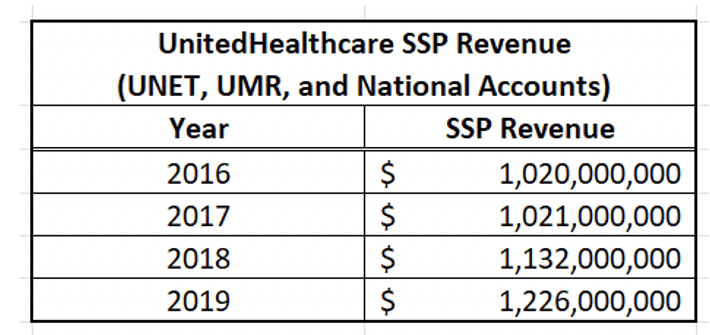

UnitedHealth cut out-of-network healthcare prices to boost fees charged to self-funded employers. From 2016 to 2019, with the help of Multiplan, UnitedHealthcare (UNH) grew its shared savings program (SSP) fee revenue earned from employers who self-fund their employee health plan.

Source: Scott Ziemer, vice president of customer solutions at UMR, a UnitedHealth, trial testimony on November 16, 2021, Fremont vs UnitedHealth

But, according to trial testimony from UnitedHealth executives, during the same period that SSP revenue was rising, out-of-network billed charges, in aggregate, were dropping.

This meant there was a shrinking pool of out-of-network billed charges eligible for creating the difference between what providers billed and what providers were paid needed for UnitedHealth to earn SSP revenue.

In the space of dwindling out-of-network provider charges, a payor seeking to maintain or grow SSP revenue would have to apply ever more aggressive reductions to out-of-network provider payments.