Published on May 24, 2023

The accounting practices of Zynex (ZYXI), a manufacturer of electrotherapy devices for pain management, are raising red flags with finance experts who questioned how the company is accounting for adjustments, allowances, and nonpayment of the claims it submits to insurers.

According to Zynex’s SEC filings, the company recognizes revenue when it ships devices and supplies to beneficiaries. This type of revenue recognition follows the standards for companies in this industry, Francine McKenna, a lecturer in accounting at the Wharton Business School, told The Capitol Forum.

“However, especially in healthcare, there should be adjustments to revenue made based on how likely those claims are historically paid by insurers. If insurance historically rejects a certain percentage of claims, they would make an allowance for it,” McKenna said, “Zynex says they are doing that, but don’t provide any detail whatsoever about those assumptions. They might not be adjusting anywhere near the true history of what they aren’t collecting.”

“The firm does not provide any quantitative analysis of the allowances. That’s a bit unusual as most firms provide at least some data,” Dr. Ed Ketz, a professor of accounting at Pennsylvania State University, said after reviewing Zynex’s SEC filings, “their description provides no data about the amounts in the allowance accounts, nor the changes in the account, nor the corresponding bad debts expense. It’s a bit strange.”

Asked about the opacity in the company’s SEC filings, Zynex CFO Dan Moorhead told The Capitol Forum that the company’s “accounting policies are quite simple and outlined clearly in our filings.”

“We have been audited by several large accounting firms during our almost twenty-year tenure as a public company in the U.S. Our current and predecessor auditors have signed off on our financial statements,” Moorhead added.

Moorhead did not respond to follow up questions asking to explain those accounting policies as well as questions regarding how tens of millions of dollars of unreimbursed claims identified by The Capitol Forum are factored into the company’s revenue recognition.

Zynex’s lack of information about non-payment of claims is important given that insurers very often deny Zynex’s claims outright. As The Capitol Forum has previously reported, Zynex has been removed from the networks of several insurers, Medicaid programs, and workers compensation funds but continues to bill those insurers for millions of dollars of equipment shipped to their beneficiaries without any expectation of payment.

In Washington State, for example, Zynex has billed $11.7 million to the state workers compensation fund between 2019 and 2022 but received less than $40,000 in reimbursement, which a spokesperson for the fund told The Capitol Forum was done in error and that “it is still [the fund]’s policy to deny claims” for electrotherapy equipment.

Moreover, a source at a small insurance company recently told The Capitol Forum that Zynex had already billed over $1 million so far this year, none of which the insurer will reimburse.

“They are probably going to bill us $2 million this year, and we are literally sending them checks for zero dollars,” the source said.

According to that source, much of that million dollars was made up of bills for monthly supplies for Zynex devices. As The Capitol Forum has previously reported, Zynex often ships an excessive amount of reusable supplies in order to bill insurers more, a practice that has caused the company’s supplies revenue to far outpace device revenue.

According to Dr. Ketz, “it is acceptable practice to bill goods when they are shipped, providing the customer wants the product.”

“Evidence of that would include purchase invoices or contracts,” Dr. Ketz continued, but “it does sound like a channel stuffing operation so that some of those sales should not be recognized.”

Indeed, this practice has been responsible for the removal of Zynex from several large insurer networks and prompted investigations into the company by both insurers and law enforcement, according to special investigators at the insurers in question who spoke with The Capitol Forum under condition of anonymity.

Despite these delinquent payments by insurers both large and small, Zynex only recently made its first disclosure of allowances. According to its most recent quarterly filing, the company is making “an allowance for uncollectible accounts of $0.4 million during the three months ended March 31, 2023,” though that amount is far short of the millions of dollars of unreimbursed claims The Capitol Forum has documented over the course of its investigation.

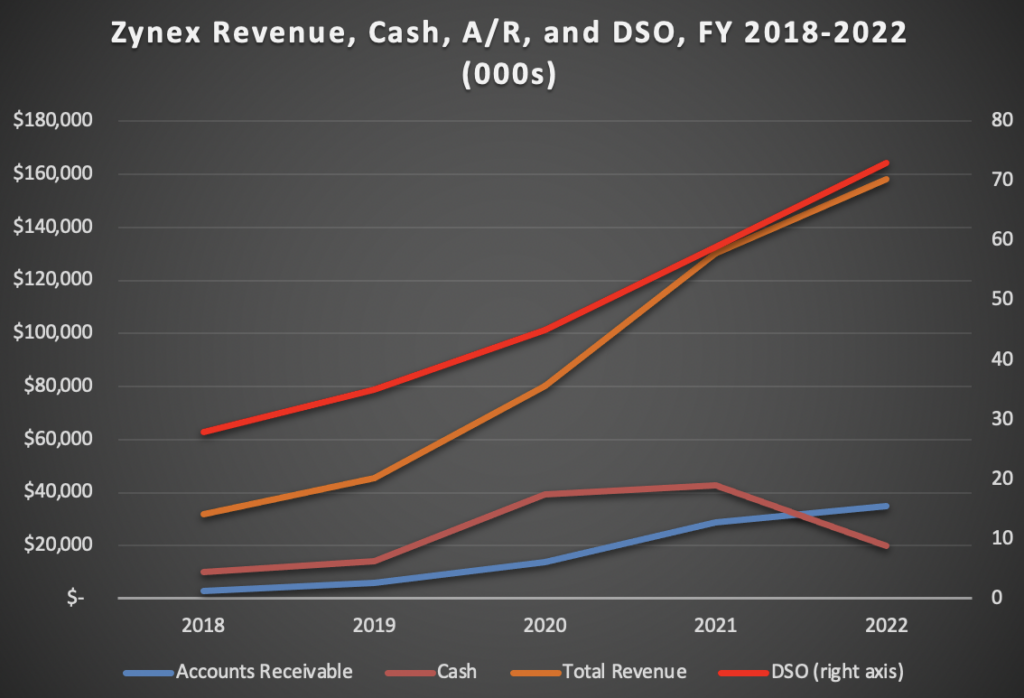

“Something may be going on here, because there is no visibility into what adjustments they are making for these doubtful accounts, which is very odd,” McKenna told The Capitol Forum, “at the same time, cash is going down while accounts receivable and days sales outstanding is growing, which suggests they aren’t getting paid quickly or maybe at all and aren’t adjusting the revenue they are recognizing to account fully for that.”

Source: Zynex SEC Filings

Critical audit finding and change of auditor. In February of 2021 Zynex disclosed that its auditor, Plante & Moran, PLLC had discovered a critical audit matter regarding how the company recognized revenue and made allowance for variable considerations in insurance reimbursements.

“Auditing the Company’s determination of variable consideration and the related constraint for revenue recognition including the recorded value for accounts receivable was challenging and complex due to the high degree of subjectivity involved in evaluating management’s estimates,” Plante & Moran wrote.

Last year, however, Zynex announced that it had changed its auditor from Plante & Moran to Marcum LLP. Zynex also disclosed that, in 2022, it identified a material weakness in its internal controls over financial reporting that it is currently in the process of remediating.

Asked about the change in auditor, Zynex CEO Thomas Sandgaard told investors last March that the split with Plante Moran was simply because “they’re no longer working with any publicly traded companies.”

However, Plante Moran appears to be currently working with several publicly traded companies, according to the Public Company Accounting Oversight Board website.

Plante & Moran did not respond to requests for comment about Zynex’s statements.